Conventional Loan Limits 2025 California. Loan limits vary by county and home size. Consider a different home that falls within the loan limits, make a larger down payment to cover the difference, or look into different types of financing, such as a conventional jumbo loan.

Borrowers with sufficient income can borrow more than these limits, by using what’s commonly referred to as a “jumbo” mortgage loan. — his candidacy would amount to a major test of voters’ appetites to challenge democratic dogma and conventional wisdom in one of the nation’s biggest, bluest states.

2025 California Conforming Loan Limits Loan Officer Kevin O'Connor, — the fhfa announces the 2025 conforming loan limits.

2025 California Conforming Loan Limits K.O. Home Loan Solutions, This protects the lender in case you.

2025 Conforming Loan Limits California Reggi Charisse, — to qualify for an fha loan in california, your home loan must be below the local fha loan limits in your area.

Conforming Loan Limits 2025 California Tori Aindrea, The amount of money you borrow with a conventional loan must also fall within conforming loan limits.

Conforming Loan Limits 2025 Key Changes and Impacts, — california conventional loan limits cap the size of mortgages so that they meet fannie mae and freddie mac guidelines.

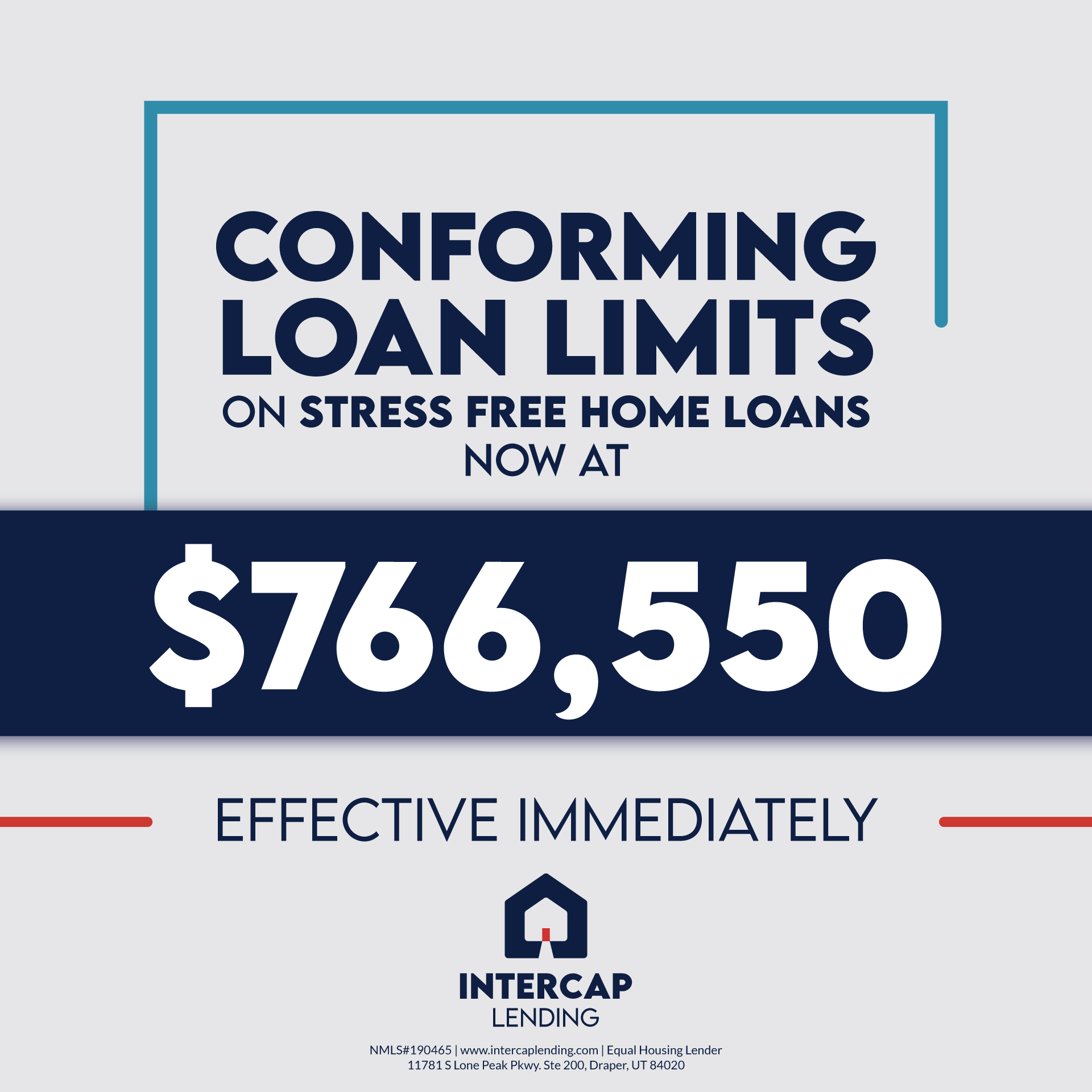

2025 Conforming Loan Limits Intercap Lending, The conforming loan limits for 2025 have increased and apply to loans delivered to fannie mae in 2025 (even if originated prior to 1/1/2025).

2025 Conforming Limits California America One Mortgage Group, The latest amendments to the housing laws have relaxed stringent restrictions and helped encourage more homeowners to construct adus on their.

2025 California FHA Loan Limits Explained District Lending, New adu laws in california 2025 feature major relaxations and offer incentives that encourage homeowners and landlords to invest in an adu right away.